Wall Street Opens Higher Amid Decline in Oil Prices

New York Stock Exchange indexes rise as investors await Federal Reserve meeting this week.

The New York Stock Exchange opened higher on Monday, buoyed by a decline in oil prices, despite ongoing military tensions between Israel and Iran.

Investors are also focused on the upcoming Federal Reserve meeting scheduled for this week.

In early trading, the Dow Jones Industrial Average increased by 187.96 points, or 0.45%, reaching 42,385.75 points.

The broader Standard & Poor's 500 index was up 0.59%, standing at 6,012.01 points, while the Nasdaq Composite gained 0.45%, also rising by 187.96 points to 42,385.75 points.

The New York Stock Exchange indices began the session on a positive note after experiencing a decline of over 1% on Friday.

The conflict between Israel and Iran had led to increased oil prices, raising concerns among investors.

The recent decline in crude oil prices provided a respite for investors concerned about a resurgence of inflation.

"The strikes have continued, but it does not appear that oil markets and shipping routes have been disrupted.

Markets are settling down a bit after Friday’s significant surprise," stated David Miller, Chief Investment Officer at Catalyst Funds.

Concerns about the inflationary effects of rising oil prices, alongside tariff-related anxieties, emerged just two days ahead of the Federal Reserve's monetary policy announcement.

While a status quo decision is largely anticipated on Wednesday, investors are likely to scrutinize comments from Fed Chairman Jerome Powell, alongside updated projections from the central bank regarding monetary policy and economic growth, in search of indications regarding potential interest rate cuts later in the year.

In corporate news, shares of US Steel rose by 4.9% after President Donald Trump endorsed a partnership between the American steelmaker and Nippon Steel, concluding an 18-month negotiation process.

Victoria's Secret saw a 2% rise amid activist efforts from Barington Capital Group, which aims to implement changes in the board of directors, arguing that the lingerie retailer has lost value since its split from former parent company L Brands in 2021.

Investors are also focused on the upcoming Federal Reserve meeting scheduled for this week.

In early trading, the Dow Jones Industrial Average increased by 187.96 points, or 0.45%, reaching 42,385.75 points.

The broader Standard & Poor's 500 index was up 0.59%, standing at 6,012.01 points, while the Nasdaq Composite gained 0.45%, also rising by 187.96 points to 42,385.75 points.

The New York Stock Exchange indices began the session on a positive note after experiencing a decline of over 1% on Friday.

The conflict between Israel and Iran had led to increased oil prices, raising concerns among investors.

The recent decline in crude oil prices provided a respite for investors concerned about a resurgence of inflation.

"The strikes have continued, but it does not appear that oil markets and shipping routes have been disrupted.

Markets are settling down a bit after Friday’s significant surprise," stated David Miller, Chief Investment Officer at Catalyst Funds.

Concerns about the inflationary effects of rising oil prices, alongside tariff-related anxieties, emerged just two days ahead of the Federal Reserve's monetary policy announcement.

While a status quo decision is largely anticipated on Wednesday, investors are likely to scrutinize comments from Fed Chairman Jerome Powell, alongside updated projections from the central bank regarding monetary policy and economic growth, in search of indications regarding potential interest rate cuts later in the year.

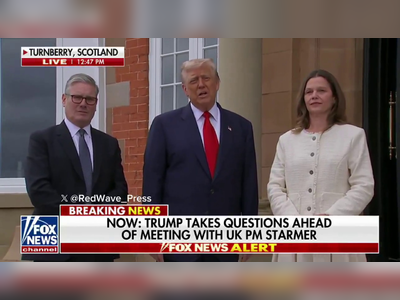

In corporate news, shares of US Steel rose by 4.9% after President Donald Trump endorsed a partnership between the American steelmaker and Nippon Steel, concluding an 18-month negotiation process.

Victoria's Secret saw a 2% rise amid activist efforts from Barington Capital Group, which aims to implement changes in the board of directors, arguing that the lingerie retailer has lost value since its split from former parent company L Brands in 2021.